Nepal’s energy landscape combines traditional energy resources, commercial technologies, and the untapped potential of alternative and renewable energy, with hydropower as its dominant sector. However, hydropower is often accompanied by traditional fuels, particularly in rural areas.

As the global alternative energy sector evolves, Nepal is increasingly transitioning to renewable sources like solar, wind, and biogas. These advancements are helping to meet energy demands, reduce greenhouse gas emissions, and improve air quality.

Despite its vast energy potential, Nepal faces significant challenges, including financial limitations, inadequate infrastructure such as transmission lines, and fluctuations in energy production. In addition to that, energy policies and plans need amendment to align with future needs. This explainer examines Nepal’s energy landscape, policies, generation, consumption, and future prospects.

Breaking Down Nepal’s Energy Plans and Policies: What’s in Store?

Nepal’s energy-related policy includes a variety of plans and policies. The Nepal Electricity Authority Act of 1984 and the Water Resources Act of 1992 are two key policies.

Other related policies are the Hydropower Development Policy of 1992 and 2001, the Local Self-Governance Act of 1998, the National Water Plan of 2005, the Rural Energy Policy of 2006, the Renewable Energy Subsidy Policy (2000-2016), and the National Energy Efficiency Strategy of 2018.

Hydropower Development Policy (2001)

The Hydropower Development Policy 2058 (2001) aims to capitalize on the country’s hydropower potential. The key objectives include electricity generation at low cost, creating a reliable electric network across the country, supporting economic activities, and promoting rural electrification.

Nepal produces about 6 million tons of waste per year, but a significant portion is dumped, burned, or left untreated. Since a majority of the waste contains organic materials, there is tremendous potential for energy generation from organic waste.

Additionally, the policy aims to develop hydropower as an export commodity, leveraging Nepal’s strategic position to meet energy demands in neighboring countries.

Rural Energy Policy (2006)

The Rural Energy Policy provides a framework to contribute in two ways: first, rural poverty reduction, and second, environmental conservation by ensuring access to clean energy in rural areas.

Some of the key aspects of the policy are to reduce dependency on traditional energy, increase employment and productivity, and ultimately improve the living standards of the rural population.

Renewable Energy Subsidy Policy (2073 B.S.)

The Renewable Energy Subsidy Policy 2073 aims to promote the adoption of Renewable Energy Technologies (RETs) to meet the nation’s energy needs.

It emphasizes short-term and long-term goals. The policy includes several strategies, including increasing access to clean energy, creating employment opportunities, and improving livelihoods.

The most important provisions of the policy are subsidies covering up to 40% of the costs of various RETs. The Renewable Energy Subsidy Policy 2073 aims to achieve universal access to clean, reliable, and affordable renewable energy by 2030.

National Energy Efficiency Strategy (2075 B.S.)

The National Energy Efficiency Strategy 2075 aims to address the country’s energy challenges by enhancing the development and efficient utilization of renewable energy resources.

The goal is to double the annual improvement rate of energy efficiency to 1.68% by 2030. Key components of the strategy include the establishment of robust policy, legal, and institutional frameworks to promote energy efficiency. It also emphasizes the need for public awareness campaigns, energy audits, and the development of national standards for energy efficiency.

Environment-Friendly Vehicle and Transport Policy (2014)

The Government of Nepal’s Environment-Friendly Vehicle and Transport Policy (2014) aims to reduce greenhouse gas (GHG) emissions and improve air quality in the transport sector.

The policy targets having over 20% of vehicle fleets be environment-friendly by 2020, with a long-term goal of 100% electric Light Duty Vehicle (LDV) sales by 2030. The policy strongly recommends the promotion of electric mobility, infrastructure development, private sector engagement, and fiscal adjustments to encourage cleaner technologies.

Green Hydrogen Policy

The newly formulated Green Hydrogen Policy outlines a comprehensive framework aimed at fostering the production, utilization, and promotion of green hydrogen and its co-products.

One of the key components of the policy is leveraging green hydrogen to ultimately reduce carbon emissions. The policy also emphasizes the expansion of green hydrogen production and infrastructure, alongside promoting and encouraging studies and research in this field.

The 16th Five-Year Plan

The concept paper for the 16th Five-Year Plan (FY 2081/82–2085/85) aims to significantly boost power generation. It targets a capacity of 11,800 MW by its conclusion. This increase is expected to facilitate the export of electricity. Another essential objective is to guarantee universal access to electricity for all citizens.

Second Nationally Determined Contribution

In accordance with the 2015 Paris Agreement, the Government of Nepal has presented its own enhanced version of the Nationally Determined Contribution (NDC) for the period of 2021–2030 in the energy sector.

The unconditional target is the expansion of clean energy generation from around 1,400 MW to 15,000 MW. The conditional target, dependent on funding, includes increasing the reliable supply of clean energy, strengthening transmission and distribution infrastructure to facilitate the expansion of e-cooking, e-heating, e-transport, and charging stations, and fostering an enabling environment for providing power to small and mid-size enterprises (SMEs) through distributed renewable energy generation sources.

Additionally, 15% of Nepal’s total energy demand should be met by renewable (clean) energy sources.

Vision 2050: What Nepal’s Energy Future Looks Like

Nepal envisions ambitious goals for the development of its energy sector by 2050. Vision 2050 aims to harness the country’s vast hydropower potential, promote renewable energy sources, and ensure energy security and sustainability.

The vision expects the installed hydropower capacity to reach 15,841 MW. Additionally, it is anticipated that per capita electricity consumption will rise significantly to 955 kWh.

By 2050, Nepal aims to ensure 100% electrification in the agriculture, industry, and transportation sectors. Furthermore, on a commercial scale, hydropower energy will not only meet domestic demand but also enable the export of surplus energy to India, China, and Bangladesh.

The vision includes the widespread adoption of technologies such as solar power, biogas, and improved cooking stoves. It is projected that alternative energy sources will supply about one-third of the total primary energy demand by 2050. The integration of off-grid renewable energy sources into the national grid is also a key component of the vision.

Nepal has the capacity to produce up to 3,000 MW of wind energy, but the country has not yet fully utilized this potential. Nepal’s middle and upper mountain regions are the most feasible for wind energy projects. Several wind-solar hybrid projects have already been implemented in various areas to supply electricity to rural communities.

This plan addresses the need for legislative and institutional reforms to support the growth of the energy sector. The establishment of a National Energy Regulation Commission, the creation of an autonomous rural electrification agency, and the enhancement of infrastructure, such as transmission lines and road access, are crucial steps identified in the vision.

Beyond Hydropower: Exploring Nepal’s Other Energy Sources

Waste-to-Energy

Nepal has enormous potential for generating energy from waste using various technologies. This energy can provide a renewable source to meet the increasing energy demands in the country.

Nepal produces about 6 million tons of waste per year, but a significant portion is dumped, burned, or left untreated. Since a majority of the waste contains organic materials, there is tremendous potential for energy generation from organic waste.

One study revealed that utilizing 100% of the organic fraction of municipal solid waste in Kathmandu could generate 130,294 cubic meters of biogas, equivalent to filling 21,045 LPG cylinders per day.

Geothermal Energy

Nepal has significant geothermal energy potential, primarily in the high hill regions. Despite the promise of this resource, Nepal lacks large-scale geothermal energy production facilities due to limited infrastructure, financial constraints, and a shortage of technical expertise.

Currently, geothermal energy is primarily utilized for therapeutic hot springs. It is estimated that Nepal has geothermal energy potential of up to 100 MW.

Green Hydrogen Fuel

Nepal’s abundant hydropower resources position the country as a high-potential producer of green hydrogen fuel. The added advantage is that the cost of producing green hydrogen in Nepal is projected to be between $1.17 to $2.55 per kg, significantly lower than the global average of $5.91 to $12.75 per kg.

Green hydrogen not only provides renewable energy but also aids in re-electrification during dry seasons, industrial applications, and the production of green ammonia for export.

Sales of kerosene in the Bagmati province are comparatively higher, followed by Madhesh, Koshi, and Lumbini provinces. Sales of LPG in the Madhesh province are notably higher, followed by Bagmati, Koshi, and Lumbini provinces.

Additionally, it supports Nepal’s commitment to transitioning to a low-carbon economy. Currently, Kathmandu University is working on various aspects of hydrogen fuel development.

Wind Energy

Nepal has the capacity to produce up to 3,000 MW of wind energy, but the country has not yet fully utilized this potential. Nepal’s middle and upper mountain regions are the most feasible for wind energy projects. Several wind-solar hybrid projects have already been implemented in various areas to supply electricity to rural communities.

Energy Supply vs. Demand: The Current Scenario in Nepal

Nepal’s Energy Supply System is divided into traditional, commercial, and modern renewable categories. The traditional energy sources mainly include firewood, agricultural residues, and animal dung.

The commercial energy sources include electricity, petroleum products, and coal. The modern renewable energy sources involve solar, wind, biogas, and Micro/Pico hydropower.

Traditional Energy Resources

Fuelwood

Nepal’s forest is one of the major sources for the majority of the population for varied purposes. It is estimated that more than 65% of Nepal’s population, especially poorer families, rely on forests for timber, fuelwood, and fodder. Altogether, forests and Other Wooded Land cover 6.61 million hectares, representing 44.74% of the country’s total area.

Nepal’s forest distribution varies across different physiographic regions. It covers 6.9% of the Terai region, 23.04% of the Churia region, 37.8% of the Middle Mountains, and 32.25% of the High Mountains.

According to the 2015 report from DFRS, Nepal’s total above-ground air-dried biomass is approximately 1,159.65 million tons, which is equivalent to 1,054.2 million tons of above-ground oven-dried biomass.

Agricultural Residues

Agricultural residue is another source of energy production. The main agricultural residues include crops like paddy, wheat, millet, and corn. Paddy is the most abundant, accounting for more than half of the total share. The estimated total energy potential is about 475 million GJ.

Animal Dung

The potential supply of animal dung was calculated by considering the populations of cattle and buffalo. The estimated total energy potential is 104 million GJ.

Commercial Energy Resources

Coal

Primarily, coal is found at four different stratigraphic positions. The main coal areas in the country are along the Churia Hill, in the Dang Valley, and in the western part of Nepal.

In fiscal year 2079/80, coal production was 2,948 tons. Coal is primarily consumed by the brick-manufacturing industry. In the case of imports, Nepal imported 1,383,000 tons of coal in the same fiscal year.

Petroleum Oils and Natural Gas

Nepal largely imports petroleum products from India. In fiscal year 2079/80, Nepal imported 675 kL, 1,382 kL, and 514 MT of petrol, diesel, and LPG, respectively.

Sales of petrol in Bagmati province are comparatively higher, followed by Madhesh, Koshi, and Lumbini provinces. In fiscal year 2079/80, sales of diesel in Bagmati province are comparatively higher, followed by Madhesh, Koshi, and Lumbini provinces.

Diesel is the dominant energy source in the transportation sector, accounting for 54.85% of the total consumption. Petrol follows with 33.95%, and Aviation Turbine Fuel (ATF) contributes 11.14%.

Sales of kerosene in the Bagmati province are comparatively higher, followed by Madhesh, Koshi, and Lumbini provinces. Sales of LPG in the Madhesh province are notably higher, followed by Bagmati, Koshi, and Lumbini provinces.

Electricity

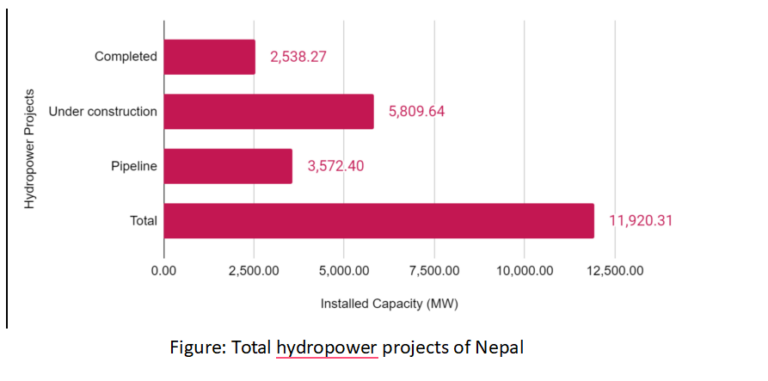

Nepal’s gross hydropower potential has been estimated at 72 thousand megawatts. Koshi province has the highest potential, while Madhesh province has the lowest. In fiscal year 2079/80, Nepal’s total generation capacity reached 2,684 MW. At the same time, Nepal exported approximately 452 MW of hydropower to India.

Largely, electricity is consumed by residential users (92.32%). Industrial and other sectors accounted for 1.31% and 6.37%, respectively. According to the 16th National Plan, 98% of the population has access to electricity through the combined national grid and alternative means.

Moreover, NEA aims to achieve 100% electrification within the next two years. The total capacity of hydropower, completed, under construction, and in the pipeline, is 11,920.31 MW.

Renewable and Alternative Energy Sources

Nepal has a huge potential in solar energy, with an average of 300 days of sunshine per year and approximately 6.8 hours of sunshine per day. Karnali Province is a major area for the utilization of Solar Home Systems, accounting for more than half of the total national SHS power generation (57.8%).

Solar irrigation is another aspect of solar energy, with high reliance on this system observed in the Madhesh Province. Institutional photovoltaic systems are concentrated in the remote and off-grid regions of Karnali and Sudurpaschim Provinces.

Wind energy generation has seen a significant increase in recent years. The total potential of wind-solar energy generation in Nepal is 475 TOE.

Another alternative energy, biogas, has been widely used mainly in Bagmati, Gandaki, and Koshi Provinces. Koshi has the highest number of Micro/Pico hydropower projects, accounting for 68.1% of the total projects.

Understanding Nepal’s Energy Consumption Patterns

Energy Consumption by Fuel Types

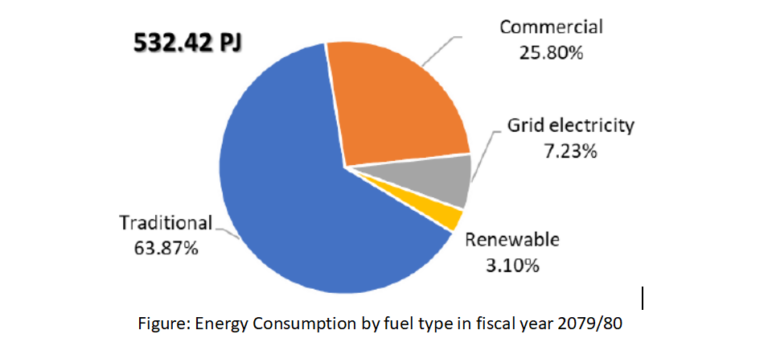

Nepal consumed 532.42 PJ of energy in fiscal year 2079/80. Among this, traditional fuels accounted for the largest share at 63.87%. Commercial fuels contributed 25.80%, grid electricity 7.23%, and renewable energy sources represented 3.10% of the total consumption.

Noticeably, energy consumption in 2079/80 decreased compared to the previous year. The key reasons include a shift towards renewable and alternative energy sources.

The sharp hike in the price of coal also impacted lower consumption in industries, thus reducing overall energy consumption.

Similarly, a decline in demand and production resulted in lower consumption of non-renewable fuels like coal and diesel. The shift from petroleum to electricity for transportation further underscores the decreasing reliance on fossil fuels.

Energy Consumption by Sector

The residential sector is the largest consumer of energy in the country, accounting for 60.75%. The industrial sector follows, consuming 20.91%. The transportation sector accounts for 10.43%, while the commercial sector uses 5.04%. The agriculture sector accounts for 0.95%, and the construction and mining sectors account for 1.92% of the total energy consumption.

In the residential sector, the largest share is from fuelwood. Other significant contributions include LPG, electricity, and biogas. Smaller contributions come from agricultural residue, animal dung, solar, Micro/Pico hydro, wind, kerosene, and coal.

Fuelwood is the predominant energy source in the commercial sector, accounting for 57.44% of the total consumption. LPG is the second-largest contributor at 16.45%, followed by solar at 11.05% and electricity at 9.89%. Other energy sources include agricultural residue, animal dung, coal, petrol, and Micro/Pico hydro. Smaller contributions come from kerosene, biogas, and wind.

The industrial sector largely consumes coal, accounting for 30.21% of the total energy consumption. Fuelwood follows at 28.66%, and electricity constitutes 11.57%.

Diesel accounts for 10.46% of the energy mix, while agricultural residue makes up 14.68%. Smaller contributions come from petrol, furnace oil, LPG, and kerosene.

Bagmati Province has more than 1 million consumers across 13 districts, with the majority falling into the domestic category. Annual energy sales totaled 2,838 GWh, accounting for 30.33% of NEA’s total energy sales.

Diesel is the dominant energy source in the transportation sector, accounting for 54.85% of the total consumption. Petrol follows with 33.95%, and Aviation Turbine Fuel (ATF) contributes 11.14%.

In the agriculture sector, diesel is the predominant energy source, accounting for 75.77% of the total consumption. Electricity follows with 22.50%, while petrol and solar contribute 1.22% and 0.51%, respectively.

The construction and mining sector mainly consumes diesel, accounting for 37.07% of the total consumption. Electricity follows with 55.47%, and LPG contributes 3.15%.

Energy Pricing Trends in Nepal: What You Should Know

From the third quarter of the year 2078 to the first quarter of the year 2080, there was an increase in the price of petrol, diesel/kerosene, and ATF.

This is likely due to the increasing global oil market. During mid-2079, there were peak prices for all fuel types. After that, there was a decline in the prices. LPG prices remained relatively stable in comparison to other fuels.

The domestic tariff rates for single-phase low voltage (230 V) vary according to the monthly consumption and electric current. The domestic tariff rates for three-phase medium voltage (33/11 kV) are NRs. 10.50 per kWh during Ashad to Kartik and NRs. 11 per kWh from Marg to Jestha. The monthly minimum charge is 100.

For three-phase low voltage (400 V), the tariff rates are NRs. 10.50 per kWh during Ashad to Kartik and NRs. 11.5 per kWh from Marg to Jestha.

The monthly minimum charge is 1,100. This applies up to 10 kVA. For more than 10 kVA, the tariff rates are NRs. 10.50 per kWh during Ashad to Kartik and NRs. 11.5 per kWh from Marg to Jestha. The monthly minimum charge is 1,800.

Province-by-Province Outlook: Nepal’s Energy Landscape Explained

Koshi Province

Koshi Province has about 1 million consumers across 14 districts, most of whom fall under the domestic category. Annual energy sales amounted to 1,552.54 GWh, marking an 11.19% rise from the previous fiscal year. Koshi Province’s sales represent 16.59% of NEA’s total energy sales.

The gross annual revenue stood at NRs. 14.47 billion, accounting for approximately 16.0% of NEA’s total revenue. The province has a distribution loss of 10.38%. Biogas is the foremost renewable energy source in Koshi Province. Total energy consumption in the province was estimated at 73,835 TJ in 2019.

Madhesh Province

Madhesh Province has more than 1 million consumers across 8 districts, with about 90% categorized as domestic users. Annual energy sales reached 2,017 GWh, reflecting a 5.47% increase from the previous fiscal year.

Sudurpaschim Province has 339,352 consumers across 9 districts, with approximately 93.17% categorized as domestic users. Annual energy sales reached 327 GWh, contributing 3.50% of NEA’s total energy sales. The gross annual revenue was NRs. 2.80 billion, about 3.10% of NEA’s total revenue.

The gross annual revenue of NRs. 18.04 billion represents 19.94% of NEA’s total revenue. The distribution loss stands at 13.79%. Biogas is the primary renewable energy source in Madhesh Province. Total energy consumption in the province was reported at 63,174 TJ in 2019.

Bagmati Province

Bagmati Province has more than 1 million consumers across 13 districts, with the majority falling into the domestic category. Annual energy sales totaled 2,838 GWh, accounting for 30.33% of NEA’s total energy sales.

The gross annual revenue was NRs. 30.18 billion, representing approximately 33.37% of NEA’s total revenue. Biogas is the leading renewable energy source in Bagmati Province. Total energy consumption in the province was reported at 83,535 TJ in 2021.

Gandaki Province

Gandaki Province has about half a million consumers across 11 districts, with approximately 95.27% categorized as domestic users. Annual energy sales amounted to 632 GWh, representing 6.75% of NEA’s total energy sales.

The gross annual revenue was NRs. 6.13 billion, accounting for about 6.78% of NEA’s total revenue. The distribution loss is 8.47%. Biogas is the foremost renewable energy source in Gandaki Province. Total energy consumption in the province was reported at 46,462 TJ in 2022.

Lumbini Province

Lumbini Province has about 1 million consumers across 12 districts, with the majority categorized as domestic users. Annual energy sales reached 1,917 GWh, accounting for 20.49% of NEA’s total energy sales.

The gross annual revenue was NRs. 18.09 billion, representing approximately 20.02% of NEA’s total revenue. The distribution loss is between 8–9%. Biogas is the leading renewable energy source in Lumbini Province. Total energy consumption in the province was reported at 77,259 TJ in 2022.

Karnali Province

Karnali Province has 139,073 consumers across 10 districts, with approximately 96.01% categorized as domestic users. Annual energy sales totaled 73 GWh, contributing 0.79% of NEA’s total energy sales. The gross annual revenue was NRs. 713 million, about 0.79% of NEA’s total revenue.

The distribution loss increased to 16.20%. Biogas is the foremost renewable energy source in Karnali Province. Total energy consumption in the province was reported at 19,594 TJ in 2022.

Sudurpaschim Province

Sudurpaschim Province has 339,352 consumers across 9 districts, with approximately 93.17% categorized as domestic users. Annual energy sales reached 327 GWh, contributing 3.50% of NEA’s total energy sales. The gross annual revenue was NRs. 2.80 billion, about 3.10% of NEA’s total revenue.

The distribution loss stands at 10.99%. Biogas is the leading renewable energy source in Sudurpaschim Province. Total energy consumption in the province was reported at 36,906 TJ in 2022.